Uncertainty regarding your financial health is a significant factor contributing to your money-related anxiety. The more you think about it, the more difficult it becomes to deal with. Use these check lists as tools for keeping your records organized and taking control of your financial future in 2026.

1. Monthly Budget Reviews

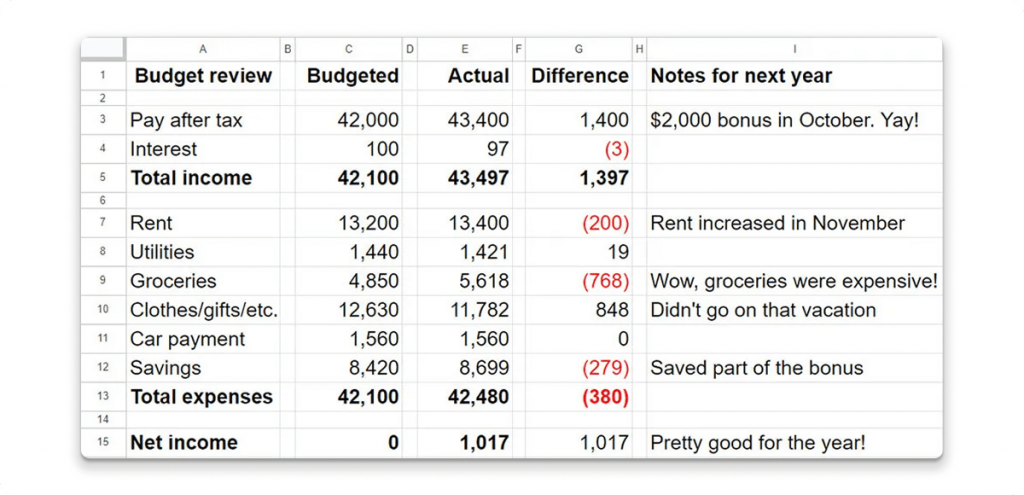

Having all of your transactions from the previous month reviewed each month will provide a picture of how all of your money was used. You can also get a picture of how well you are budgeting based on your financial goals.

Start with your various income sources, followed by the fixed expenses including rent, utilities, monthly subscriptions, insurance, and monthly loan payments. Also consider your changing expenses including food, transportation, and entertainment. Finally, add in all of your savings and investments. This will allow you to see how much you will earn and how your income will be divided amongst the various financial accounts.

source: Britannica

By checking to see if your budgeted and actual expenses match each month, you will identify areas for improvement. You will also be able to see what your spending habits look like, and that you have created a consistent budgeting strategy that aligns with your financial plan.

2. Emergency Fund

An emergency savings account is a means of transforming unexpected financial issues into minor annoyances rather than major crises. To build your emergency savings account successfully, you should establish a firm goal based on your goal.

It is important to maintain records of your current savings and the amount of money you will contribute to your emergency fund each month. You should also establish criteria to determine what constitutes an emergency.

You should periodically review your progress toward your emergency fund goal to sustain your motivation. Once you reach your goal, your emergency fund will be one of the most reassuring aspects of your overall financial profile.

3. Debt Payoff Roadmap

It is common to feel overwhelmed by the burden of debt. Creating a roadmap that lays out your debt repayment plan will clearly outline the various steps necessary to eliminate each debt. When preparing a repayment plan, create a list with:

- The amount owed on each account

- Interest rates charged

- Repayment dates for each month

- Minimum monthly payment required

After creating your repayment plan, determine how to systematically pay off your debts using one or more methods. You could choose to make payments towards your highest interest debt first or work down the smaller debts for fast satisfaction. You can also look for opportunities to refinance your existing debts.

4. Create an Investment Review Routine

Investments are best when they support your investment objectives rather than changing frequently. A standard investment review routine can keep you focused on your strategy.

Have a written record of where all of your investments are allocated, how much each investment will cost you, and how each investment is performing according to your expectations. Record whether each investment still matches your timeline and risk profile.

Conducting an annual or semi-annual review can help ensure that your investment plan remains solid and unimpacted by short-term fluctuations.

source: Rule#1Investing

5. Alternative Assets Starter List

Alternative assets will help round out your overall financial picture. They may also be a good way to diversify your investments. If you have access to these assets, ensure you are documenting them.

You can track the value of your alternative assets by knowing when you bought them, how much you paid for them, where they’re stored and how easily you could sell them. There is also a lot of documentation related to physical assets and their value, including information on authentication, protection through insurance, and changes in market demand.

If you are just starting to explore alternative assets, you can see Gold Eagle coin options as a familiar example of a liquid hard asset.

6. Conduct a Review of Your Insurance Coverage

Until the time you need your insurance, it may not seem important. Conducting a review of your insurance policies every year will ensure that you have the right amount of protection without the risks associated with overbuying.

When renewing your insurance coverage, review each of your existing policies for coverage limits, deductibles, beneficiaries, and renewal dates. As your life changes, your level of insurance should change.

When all of your insurance information is written down, you can easily see potential gaps and overlaps in coverage. Proper insurance may help you avoid the potential for significant financial stress and expense later.

7. Quarterly or Annual Snapshot of Your Net Worth

Understanding your net worth is very important when trying to determine your financial position. Examine all your assets and debt to determine how best you can organize your money. Your assessment should include everything including cash, savings, investments, property, retirement plans, and valuables. Look out for important motivating indicators of how well you are growing toward your long-term financial goals.

8. Subscription and Bill Review

You likely have many subscription and reoccurring charges showing up on your bank statement that are unnoticeable because they feel insignificant and become just another automatic charge; the subscription review looks at your auto-billed subscription and/or reoccurring charges including all digital platforms you pay for, rental of spaces, etc., insurance, auto-billed applications, and any automatic contributions to charities.

By doing this review twice a year, you will find services that still provide value but only collect $15 to $30 a month and/or not be aligned and you can either cancel or downgrade to decrease the number of unwanted charged by eliminating a subscription you weren’t using and freeing resources to pay for essentials.

9. Organizing Your Financial Documents and Passwords

Organizational problems can create an excess amount of financial stress. During an emergency or when you have experienced a major life change, you should not have trouble knowing where to find all of your important financial documents or how to get to them.

If you can, develop a safe and secure system to track where your bank accounts, insurance policies, and other important documents are located, and include how to access them.

source: FirstBusiness

It will also decrease confusion and reduce delays caused by not having enough time to find urgent information. Having access to key apps and financial tools can help you stay on top of your finances by avoiding having them land in the wrong hands.

This will ensure no unauthorized person gains access to your money. This way, you will be able to account for every cent that enters and leaves your account.

10. Reviewing Tax Planning and Responsibility

While tax obligations happen throughout the year and are due at the time of filing, it is important to have an ongoing checklist completed so that you can track where all of your income is coming from, what you can deduct for your expenses, when you must file your returns, and what documents you will need throughout the year.

After regularly reviewing this checklist, you can plan your tax payments, avoid penalties, and identify legitimate ways to reduce your tax liability. If you have multiple income streams or are self-employed, this checklist will help provide a structure to tax season and reduce your uncertainty.

11. Financial Goal Alignment Review

Money serves you best when it is used to facilitate the life that you are creating for yourself. An annual financial goal alignment review assesses your current spending, saving, and investing habits, and compares them to your set short and long term financial goals.

As your life circumstances change, your financial strategies need to adapt as well. A review of this checklist on an annual basis will ensure that your financial decision making will be based on your current priorities rather than former assumptions or outside expectations, thus providing meaning and direction in your financial life.

12. Looking Back at Finances

Taking the time to look back at your finances allows you to step back from the mechanics of your monthly budgets and look at the bigger picture. This isn’t about how much you spent versus how much you earned. It is about how many patterns or habits you have created or continue to create around successfully managing your money. Ask yourself, what continues to work? What has caused you stress? What feels in alignment with what is important to you?

Complete a checklist of major financial decisions you made, unexpected challenges that arose, and good things that have happened in your financial life, regardless of whether they are large or small.

Establish a few reasonable adjustments you can make in the coming year instead of large and unrealistic goals. Consider this as a time for reflection and resetting. It will help you to be intentional, clear, and in control of your money.

Take Charge Of Your Finances

You do not need to completely change your financial situation in 2026 in order to feel more in control of your finances. A single checklist, reviewed regularly, will significantly alter how you view your financial life. Start with the area of your life that causes you the greatest amount of stress and you will get the clarity you need.