Applying for a loan should feel like the beginning of something big, whether that’s buying a home, launching a business, or paying for college. But for many customers, the experience still feels stuck in the past. They wait in long lines, get rerouted between departments, or leave with more questions than answers. Bank staff, meanwhile, are often stretched thin.

Customer loyalty and satisfaction depend on a seamless loan application procedure. According to a recent study, 70% of consumers would move banks in search of a better online experience. This emphasizes how banks must update their procedures to satisfy the needs of their tech-savvy customers.

That’s why banks and credit unions use appointment scheduling tools for loan applications. These digital options arrange how people work, improve how they communicate, and boost the experience of all involved. By leveraging technology, financial institutions can streamline operations, reduce inefficiencies, and align with the growing demand for seamless digital services

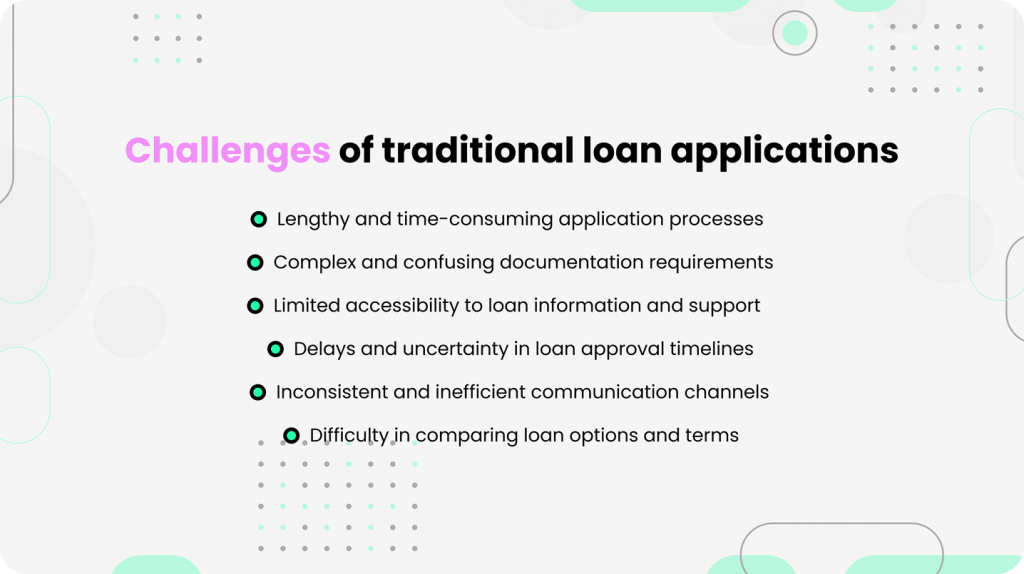

The Challenges of Traditional Loan Application Processes

Despite all the progress in digital banking, the loan application process remains a major friction point. Managing drop-ins, making phone appointments, and looking for papers are still standard procedures. For instance, a customer may phone to make an appointment, only to find out when they get there that the time slot was misplaced or double-booked, resulting in aggravation and wasted time. In addition to ruining the customer’s day, this puts more strain on the bank employees who have to work quickly to fix the problem.

Here’s where traditional approaches fall short:

- Appointments often double-book or get lost in the shuffle

- Walk-ins overwhelm staff and extend wait times

- Customers lack clear next steps or reminders

- Staff burn time hunting for documents or chasing down information

The result? Confusion, delays, and frustrated customers. These inefficiencies can damage a bank’s reputation and drive customers to competitors who offer more modern, streamlined solutions.

Key Benefits of Appointment Tools for Loan Applications

From initial contact to final approval, banking appointment scheduling software provides a means to streamline and reinforce the sometimes complicated loan application process. Financial firms can improve appointment scheduling, customize customer service, and expedite internal processes with the aid of these solutions.

Below are some of the most impactful benefits of using appointment scheduling tools for loan applications in today’s banking environment.

Streamlined Scheduling and Coordination

Appointment scheduling tools for loan applications allow clients to choose a time online, receive automated reminders, and arrive prepared. Meanwhile, staff can plan ahead and focus their time where it matters most. According to a report by McKinsey, banks that implement digital scheduling tools see a 15-20% increase in operational efficiency. This is because staff can better manage their schedules, reducing conflicts and ensuring smoother appointment flows.

One financial institution saw a 40% drop in no-shows within the first quarter of adopting a digital scheduling platform. That’s a major improvement in both efficiency and customer satisfaction. Take the case of Bank X, which implemented an appointment scheduling tool and saw a 30% increase in on-time appointments, cutting wait times and boosting customer approval ratings.

Enhanced Customer Experience

Loan applications are stressful enough. A good scheduling system helps customers feel supported, not shuffled. Banks may foster trust and lessen client concern by offering a smooth booking process. According to a survey, for example, 85% of consumers prefer banks that use online appointment booking over those that still use antiquated techniques.

They can easily book online, reschedule, and avoid waiting on hold. That freedom builds trust. Over 80% of customers now expect digital services that match the convenience of in-person banking. A study by J.D. Power found that banks with high digital satisfaction scores have a 10% higher customer retention rate, underscoring the value of a smooth, tech-driven experience.

Improved Staff Efficiency

Staff who know who’s coming and what’s needed can focus on the task at hand. They’re not juggling calls, walk-ins, and backlogs. This preparation can reduce the time spent per customer by up to 20%, as staff have all the necessary documents and details ready before the appointment begins.

Supervisors can monitor performance, adjust workloads, and spot scheduling trends, all of which improve the way teams operate. This visibility helps managers allocate resources effectively, ensuring staff are neither overwhelmed nor underutilized.

Faster Loan Processing Times

Digital scheduling systems also enable loan processing automation. Documents can be collected in advance, appointments can be aligned with availability, and communication flows seamlessly. According to a prominent credit union, they gained a competitive edge in a market that moves quickly after putting in place an automated scheduling system, which reduced their average loan approval time from 10 to 7 days.

The turnaround time for loan applications has improved by more than 25%, according to several institutions that use automation.In competitive markets, that edge makes a real difference.

Data Security and Compliance

Security must be built in, not bolted on. Modern scheduling tools meet stringent privacy standards, think SOC 2, CCPA, and GDPR, with encrypted data storage, permission controls, and access logs. This is vital in an era where data breaches can cost banks millions and erode customer trust. Secure appointment tools ensure sensitive information is protected while meeting regulatory requirements.

A major bank was fined after exposing sensitive information using outdated methods. Today’s digital tools, including Q-nomy’s platform, are built to avoid those risks entirely.

Choosing the Right Appointment Tool for Loan Processing

Not all software is built for banking. Some lack critical features like compliance protocols, reporting, or loan system integration.

When selecting a solution, focus on loan application appointment software that includes:

- Smooth calendar and CRM interfaces to guarantee that all customer data is in sync, minimizing errors and human entry.

- Clients may make appointments while on the go thanks to mobile-friendly booking, which improves accessibility and convenience.

- Automated follow-up emails and reminders to reduce no-shows and alert clients, improving their experience in general.

- Analytics help optimize operations by managing customer and employee flow and provide insights into peak hours and employee performance.

- High-level security with audit trails to safeguard sensitive data and ensure compliance, which is a non-negotiable in banking.

- Compatibility with your loan origination system to streamline the entire loan process by integrating scheduling with existing banking systems.

Q-nomy’s solution stands out for precisely these reasons. It’s designed specifically for the banking sector, helping branches serve clients more effectively while meeting every compliance requirement. Their banking appointment scheduling software integrates seamlessly with existing systems, offering a comprehensive tool for managing loan applications efficiently.

In Conclusion

Using loan application appointment software is much more than a trend; it’s a smart business move. As a result, banks are able to support customers better, decrease delays, and organize team tasks in a simpler way. Banks that adopt digital tools like these will remain ahead of the curve as technology advances, satisfying growing client demands and prospering in a cutthroat market.

It also aids in the automation of loan processing, which expedites decision-making and enables lenders to handle more loans. Q-nomy and other tools provide financial institutions with the speed needed to survive in a changing financial environment.

Have you implemented appointment scheduling at your bank or credit union? Has it helped your workflow, or left you with new questions? I’d love to hear your take. Leave a comment or reach out — let’s compare notes and build a smarter way forward together.